Discover Exactly How to Order Cryptocurrencies: Necessary Steps for New Investors

Exploring the Advantages and Dangers of Purchasing Cryptocurrencies

The landscape of copyright investment is defined by a complex interaction of compelling advantages and considerable risks. As we additionally check out the subtleties of copyright financial investment, it comes to be noticeable that notified decision-making is vital; nonetheless, the inquiry remains: Just how can capitalists effectively stabilize these benefits and dangers to protect their financial futures?

Understanding copyright Essentials

As the electronic landscape progresses, recognizing the fundamentals of copyright becomes important for possible investors. copyright is a kind of electronic or virtual currency that utilizes cryptography for security, making it hard to imitation or double-spend. The decentralized nature of cryptocurrencies, normally constructed on blockchain innovation, improves their protection and transparency, as purchases are recorded across a distributed journal.

Bitcoin, produced in 2009, is the first and most widely known copyright, but hundreds of options, referred to as altcoins, have actually arised given that after that, each with special features and purposes. Investors need to acquaint themselves with vital concepts, consisting of budgets, which save exclusive and public tricks essential for transactions, and exchanges, where cryptocurrencies can be purchased, marketed, or traded.

Additionally, comprehending the volatility associated with copyright markets is crucial, as rates can rise and fall significantly within brief periods. Regulatory considerations also play a considerable function, as different nations have varying positions on copyright, impacting its use and approval. By comprehending these foundational aspects, possible capitalists can make informed decisions as they browse the complicated globe of cryptocurrencies.

Secret Advantages of copyright Financial Investment

Buying cryptocurrencies provides numerous engaging benefits that can attract both amateur and seasoned capitalists alike. Among the primary advantages is the potential for significant returns. Historically, cryptocurrencies have exhibited impressive cost gratitude, with early adopters of properties like Bitcoin and Ethereum understanding substantial gains.

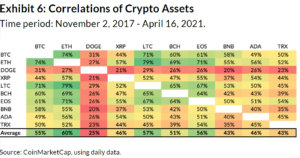

One more key benefit is the diversification opportunity that cryptocurrencies provide. As a non-correlated asset course, cryptocurrencies can function as a bush versus standard market volatility, enabling capitalists to spread their risks throughout different financial investment vehicles. This diversity can boost general profile efficiency.

In addition, the decentralized nature of cryptocurrencies uses a level of freedom and control over one's assets that is frequently doing not have in conventional finance. Capitalists can manage their holdings without intermediaries, possibly minimizing charges and increasing transparency.

In addition, the expanding approval of cryptocurrencies in mainstream financing and business additionally strengthens their value proposal. Lots of organizations now approve copyright repayments, leading the way for broader adoption.

Finally, the technical technology underlying cryptocurrencies, such as blockchain, offers possibilities for financial investment in emerging fields, including decentralized finance (DeFi) and non-fungible symbols (NFTs), enriching the financial investment landscape.

Significant Threats to Take Into Consideration

Another crucial danger is regulative uncertainty. Governments worldwide are still creating plans relating to cryptocurrencies, and modifications in regulations can considerably affect market dynamics - order cryptocurrencies. A negative governing environment could limit trading and even cause the outlawing of specific cryptocurrencies

Protection threats also pose a considerable danger. Unlike traditional financial systems, cryptocurrencies are vulnerable to hacking and fraud. Investor losses can occur if exchanges are hacked or if exclusive keys are endangered.

Finally, the lack of customer securities in the copyright area can leave capitalists at risk - order cryptocurrencies. With restricted choice in the occasion of fraud or burglary, people may locate it challenging to recuperate shed funds

Taking into account these dangers, complete study and risk assessment are essential before involving in copyright financial investments.

Approaches for Successful Spending

Creating a robust method is vital for navigating the complexities of copyright investment. Investors need to start by carrying out detailed research to recognize the underlying technologies and market dynamics of numerous cryptocurrencies. This consists of staying notified concerning trends, regulative growths, and market sentiment, which can considerably influence property efficiency.

Diversification is another essential technique. By spreading financial investments across several cryptocurrencies, investors can reduce dangers related to volatility in any type of solitary asset. A healthy portfolio can offer a barrier versus market fluctuations while boosting the possibility for returns.

Setting clear investment objectives Resources is critical - order cryptocurrencies. Whether going for short-term gains or lasting wealth build-up, defining certain goals assists in making educated decisions. Applying stop-loss orders can likewise safeguard financial investments from considerable recessions, permitting a disciplined exit strategy

Last but not least, continual tracking and reassessment of the financial investment strategy is important. The copyright landscape is vibrant, and routinely assessing performance against market conditions makes sure that capitalists continue to be dexterous and responsive. By adhering to these strategies, capitalists can enhance their opportunities of success in the ever-evolving globe of copyright.

Future Trends in copyright

As investors improve their methods, comprehending future patterns in copyright becomes increasingly essential. The landscape of electronic money is progressing rapidly, influenced by technological innovations, regulative advancements, and moving market characteristics. One substantial trend is the increase of decentralized financing (DeFi), which aims to recreate typical monetary systems utilizing blockchain innovation. DeFi procedures are gaining traction, using cutting-edge monetary products that might reshape exactly how individuals involve with their assets.

Another emerging fad is the growing institutional passion in cryptocurrencies. As business and monetary establishments adopt electronic money, mainstream approval is likely to boost, potentially bring about higher price stability and liquidity. Additionally, the combination of blockchain innovation into numerous industries hints at a future where cryptocurrencies function as a foundation for purchases throughout look these up fields.

Moreover, the governing landscape is developing, with federal governments seeking to develop frameworks that stabilize innovation and consumer security. This regulatory clearness can promote a more stable investment setting. Finally, advancements in scalability and energy-efficient consensus mechanisms will attend to problems surrounding deal rate and environmental influence, making cryptocurrencies much more practical for day-to-day usage. Understanding these trends will certainly be critical for capitalists aiming to navigate the complexities of the copyright market effectively.

Final Thought